Ein 0,3-mm-Nanokeramik-Substrat kippt stillschweigend das technologische Gleichgewicht des Milliarden-Dollar-AI-Computermarktes. In der neuesten DGX -AI -Server von Nvidia von Nvidia, Die Leiterplatte Der Wert pro Einheit ist auf 12.000 Yen gestiegen – five times higher than traditional servers. These “computing engines” rely on meticulously arranged circuit networks resembling electronic neural systems, Umgang mit Hochgeschwindigkeitsdaten fließt bis zu 112 Gbps.

In H1 2025, Shengyi Elektronikprojekte 432%-471% Yoy Nettogewinnwachstum, mit Branchenführern wie Avary Holding und Shengyi Technology übertroffen 50% Wachstum. Hinter diesem Anstieg befindet sich ein heftiger Kampf um die häusliche Ersetzung von Fortschritten PCB -Materialien:

-

Globale Versorgungslücke für hochwertige elektronische Materialien: 25%-30%

-

Preisschub seit 2024: 250%-300% Für bestimmte Modelle

-

AI -Server Kohlenwasserstoffharzpreise: ¥ 1.000.000/Tonne (60× Epoxidharz)

Materielle Revolution: Technische Engpässe durchbrechen

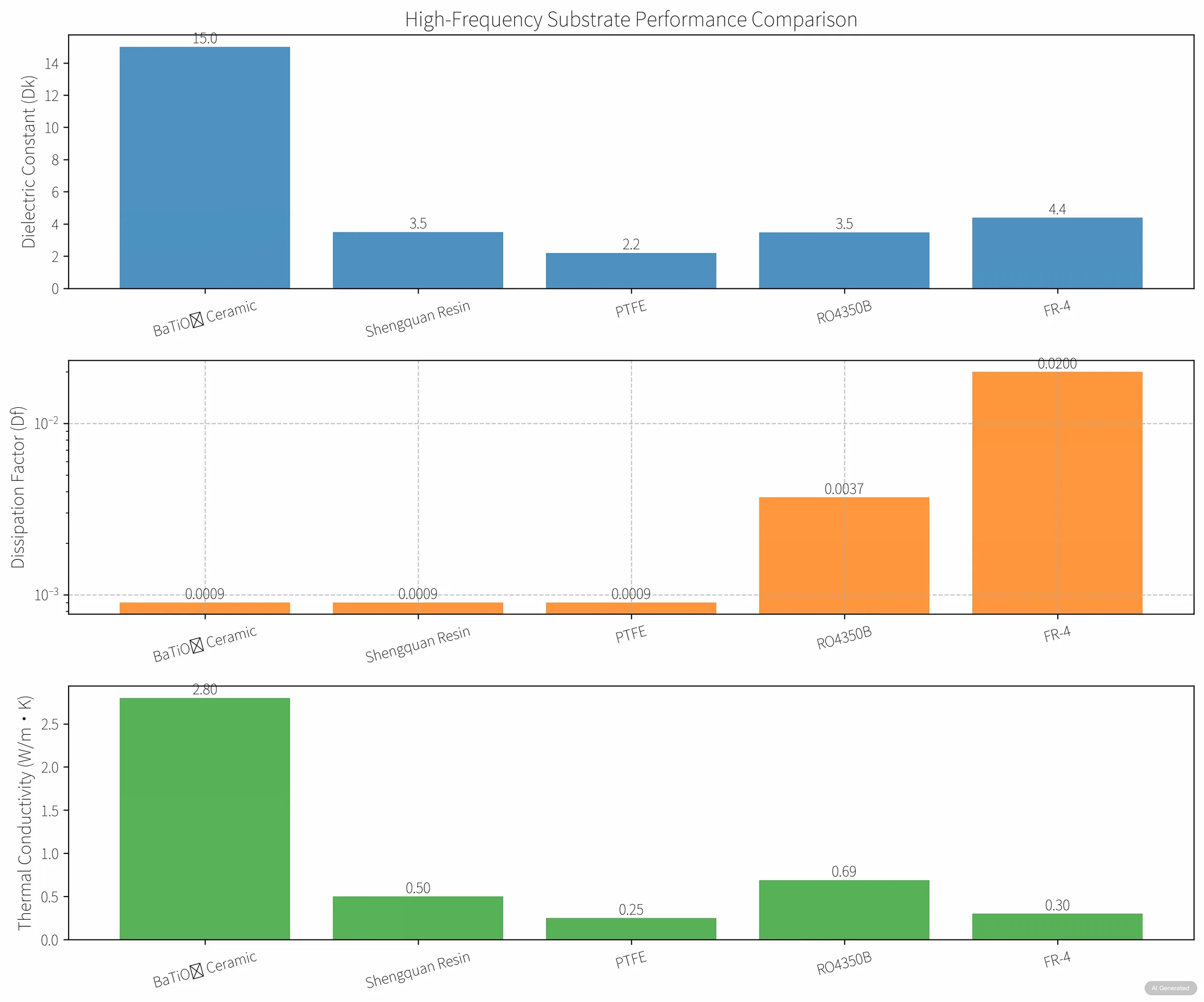

Hochfrequenzmaterielle Durchbrüche bilden das Kernfeld für die Chinas PCB-Branche. Angetrieben von 5G MMWAVE -Kommunikation und KI -Chips, Traditionelle FR-4-Substrate (Df>0.02 Ursache >0.8DB/Zoll -Signalverlust) Die High-End-Anforderungen nicht erfüllen.

Materielle Innovationen im Nano-Maßstab

-

Batio₃-Nanokeramik-Substrate erreichen DK = 15 ± 0,5, Df<0.001 bei 10 GHz mit 2,8 W/m · k thermischer Leitfähigkeit (9× Verbesserung)

-

Shengquan Group erfasst 20% Marktanteil mit Ultra-Low-Loss-Harzen (Df<0.001), Eintritt in die GPU -Lieferkette von Nvidia

-

Die aggressive Expansion der Shiming-Technologie auf eine Kapazität von 2.500 Tonnen durch 2026 wird abdecken 31% des globalen Nachfragewachstums

Domestic Resin “Big Three” Emerge

-

Dongcai -Technologie: 3,500-TON -Kapazität von TUC zertifiziert

-

Shengquan -Gruppe: Q1 2025 Nettogewinn ↑ 50,46%

-

Shiming -Technologie: $760M-Bewertung mit 140 Mio. USD projizierte Einnahmen nach dem Expansion

Fertigungsentwicklung: Vom HDI zum Nano-Ceramic-Paradigmenwechsel

Da 5G -Basisstationen zu MMWAVE- und AI -Server -PCBs erreichen 20-30 Schichten, Die Branche wechselt vom Dichtewettbewerb zur Leistungsrevolution.

Hybridmaterialbrettungen

-

Lokalisierte Hochfrequenzmaterialtechnologie bettet Rogers Ro4350b ein (Df = 0,0037) in Signalschichten, Reduzierung des 28 -GHz -Einfügungsverlusts durch 18% während der Kosten senken 22%

-

Z-Achse CTE-Differential komprimiert zu <5ppm/° C. durch Harzbrücken, vorübergehend 50,000 Wärmezyklen

Präzisionsfertigung im Nano im Maßstab

-

LDI -Adoption, aus denen sich erheben kann 45% (2025) Zu 75% (2030), Aktivierung von 0,1 mm Leitungsbreite

-

Die ersten 70-layer-PCB der Welt der Welt + 6-Schritt 24-Schicht HDI erreicht

-

Shennan Circuits’ IC substrates reach 15μm line width (1/6 menschliches Haar)

Marktumstrukturierung: Goldenes Fenster für häusliche Substitution

2025 Globaler PCB -Markt: $96.8B (China: $60B >50% Aktie), noch <35% Selbstversorgung in High-End-Segmenten schafft beispiellose Chancen.

Die Berechnung der Revolution treibt die Nachfrage an

-

AI -Server -PCB -Wert: $700/Einheit (3× traditionell)

-

2024 Globale AI -Server -Sendungen: 421,000 Einheiten → 28% HF -PCB -Wachstum

-

Nvidia Rubin Backplane: $200,000/Einheit → Gewinnpotentum von 2,3 Mrd. USD

Expansion der Kfz -Elektronik

-

EV -Elektronikdurchdringung: >65% → Automobil -PCB -Aktien ↑ 12% (2020) Zu 20% (2025)

-

L4 autonomer Fahrzeug -PCB -Wert: >$280

-

BMS -PCBs richten Sie -40 ℃ ~ 150 ℃

-

LIDAR RIGID-FLEX-PCB: 0.2mm Dicke, <1MM Bend Radius

Richtlinienunterstützung: Autonome Lieferketten bauen

Chinas 14. Fünfjahresplan priorisiert Priorität Hochleistungs-PCBs Und Fortgeschrittene CCL -Materialien. Regionale Initiativen umfassen:

-

Guangdong’s “glass fiber → CCL → PCB → packaging → smart devices” cluster

-

Chongqing's $ 2,8 Mrd. PCB Industrial Base

-

Die integrierte Lieferkette der Guangde Economic Zone

EU CBAM-Vorschriften treiben Öko-Upgrades vor: Avarys führende Prozessabdeckung >80%, Einschicht-Energieverbrauch ↓ 25%.

Zukünftiges Schlachtfeld: Vom Fertigungszentrum zum Wert von Ökosystem

Mit CR10 at 58%, Chinas PCB -Branchenübergänge vom Skalenwettbewerb in die Ökosystemkriegsführung.

Technologische Konvergenz

-

Shengyi Techs M4/M6 HF CCL: Rogers-Grad bei 30% geringere Kosten

-

Programmierbare Substrate mit DK = 6-12 Dynamische Einstellung für 6G

Globale Expansionsstrategien

-

Dongshan Präzision: 15% Tarifreduzierung über die Vietnambasis

-

Avary erwirbt M-Flex für Automobile FPC Tech

-

Shennan Circuits kauft ASMPT für IC -Substratfunktionen

Smart Factory Paradigmen

-

“Dark factories” achieve 100% Ausrüstung Konnektivität

-

KI -Inspektion: >99% Fehlererkennung

-

Laminierungsrendite ↑ 92% bis 99.1%

Strategische Roadmap: Dominierende Milliarden-Dollar-Möglichkeiten

Gesichtsansicht 25% CAGR in AI -Servern (2.37M Einheiten von 2026), Konzentrieren Sie sich auf drei Fronten:

Materielle Unabhängigkeit

Batio₃ nanokeramische Substrate bei 25% Kostensenkung

Kfz -Elektronik

High-Temp-BMS-FPCs mit 15% Widerstandsreduzierung

Intelligente Fertigung

AI-gesteuerte Systeme schneiden Prototyping aus 7 Tage zu 48 Std.

Chinas PCB -Industrie steht an einem Wendepunkt. Unternehmen beherrschen HF -Substrat -Kerntechnologien und Gebäude vertikale Ökosysteme wird elektronische Verbindungsstandards der nächsten Generation definieren.

Nutzen Sie Doppelmöglichkeiten in AI Computing und Automobilelektronik. Kontaktieren Sie uns for custom high-frequency PCB solutions – Your technical challenges drive our breakthroughs.