The Quiet Material Revolution Reshaping Electronics

Intel’s 2024 global debut of glass substrate packaging technology detonated a seismic shift in semiconductor manufacturing. At the 2025 Suzhou TGV Industry Summit, technical leaders from Intel, TSMC, and Samsung concurred: “Glass substrates will drive semiconductor packaging into a ‘transparent era,’ with market penetration exceeding 50% within five years.” This analysis explores the technological rationale, industrial chain transformation, and implications for PCB industries.

1. Technical Superiority: Why Glass Substrates Redefine Packaging

1.1 Physical Property Dominance

Comparative analysis reveals glass substrates’ overwhelming advantages :

| Parameter | Organic Substrates | Silicon Interposers | Glass Substrates |

|---|---|---|---|

| Dielectric Constant | 4.2-4.8 | 11.9 | 3.9 |

| Loss Tangent | 0.02-0.04 | 0.001-0.01 | 0.0001-0.001 |

| CTE (ppm/°C) | 16-18 | 2.6 | 3.2-7.5 (tunable) |

| Thermal Conductivity | 0.2-0.3 | 150 | 1.1 |

| Surface Roughness | 0.5-1.0 μm | 0.05 μm | <0.01 μm |

(Source: Intel Technical White Paper, Corning Materials Lab)

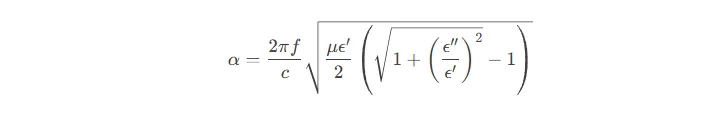

Signal Loss Equation Analysis

Attenuation (α) is defined as:

With ε’≈3.9 and ε”≈0.001 for glass substrates, high-frequency (100GHz) losses reduce by 67% versus organic substrates (ε’≈4.5, ε”≈0.03).

1.2 Exponential Density Enhancement

NVIDIA’s GB200 GPU demonstrates 50%+ die count increase using glass substrates, achieving 5μm/5μm wiring density through:

-

Atomic-level flatness (<0.01μm roughness)

-

Tunable CTE matching (3ppm/°C)

-

Mechanical stability (700×700mm panel warpage <50μm)

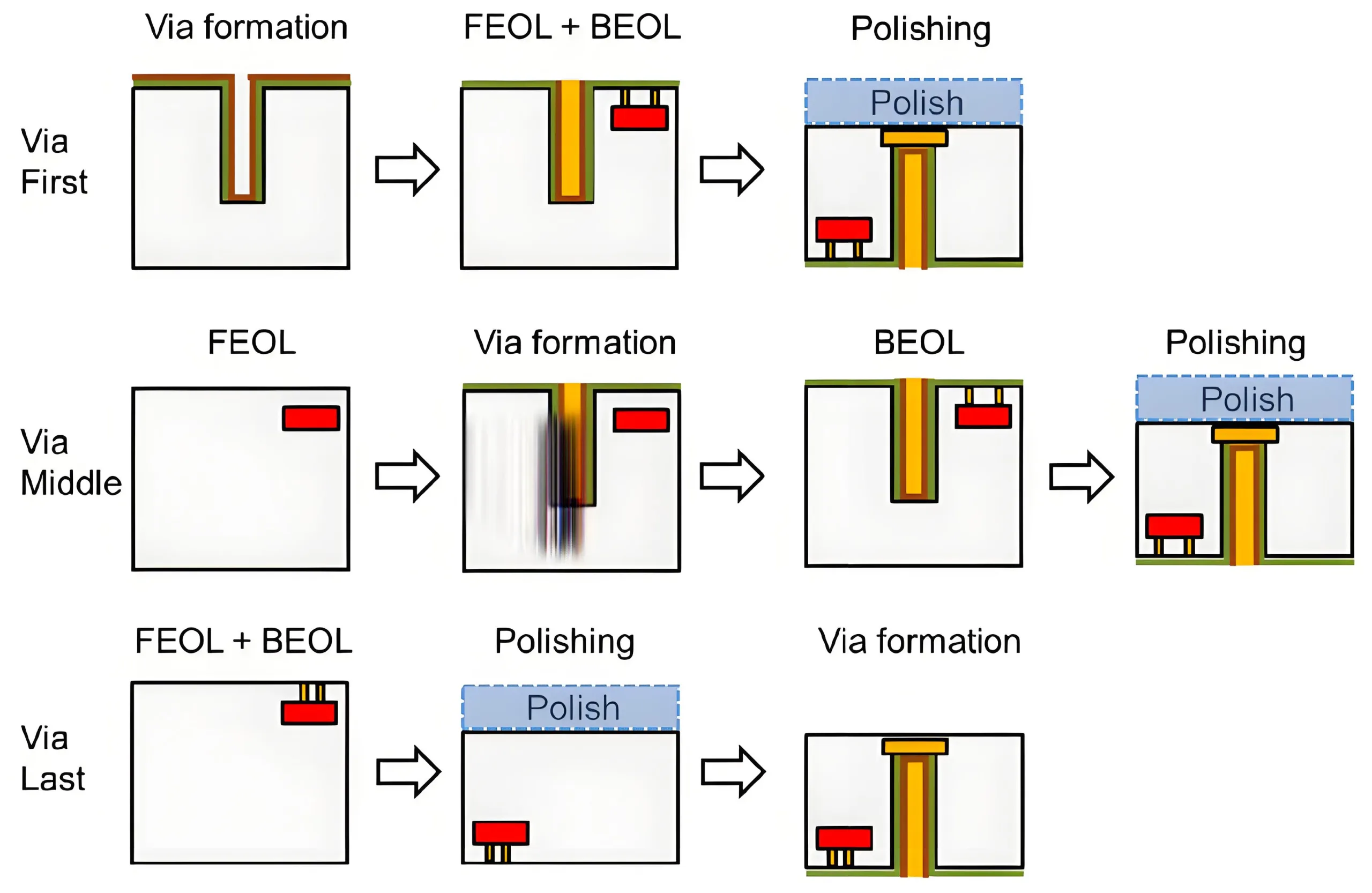

2. Process Innovations: Industrializing TGV Technology

2.1 Through-Glass-Via Manufacturing Breakthroughs

Titanrise Tech’s laser modification achieves 8,000 vias/sec at ±5μm precision (3σ), 160× faster than conventional methods. Key steps:

-

Picosecond Laser Modification: Creates micron-scale altered zones

-

HF Etching: Achieves 100:1 aspect ratio

-

Metallization: PVD sputtering + electroplating (>15MPa adhesion)

2.2 Metallization Advancements

Four technical routes address glass adhesion:

-

Electroless Cu + Micro-etching (AKM Solutions)

-

Nano-Ag Paste + LT Sintering (Wintech Patent)

-

Plasma Grafting (IME-CAS Technology)

-

PVD Ti/Cu Stack (Titanrise Standard)

Among them, UGPCB has invested heavily in introducing the DEP600 equipment, which adopts high aspect ratio sputtering technology, achieving 95% coverage in 10:1 hole profiles, with a metal resistivity of less than 2.5 μΩ·cm, reaching an internationally leading level.

3. Industry Landscape: Global Competition Intensifies

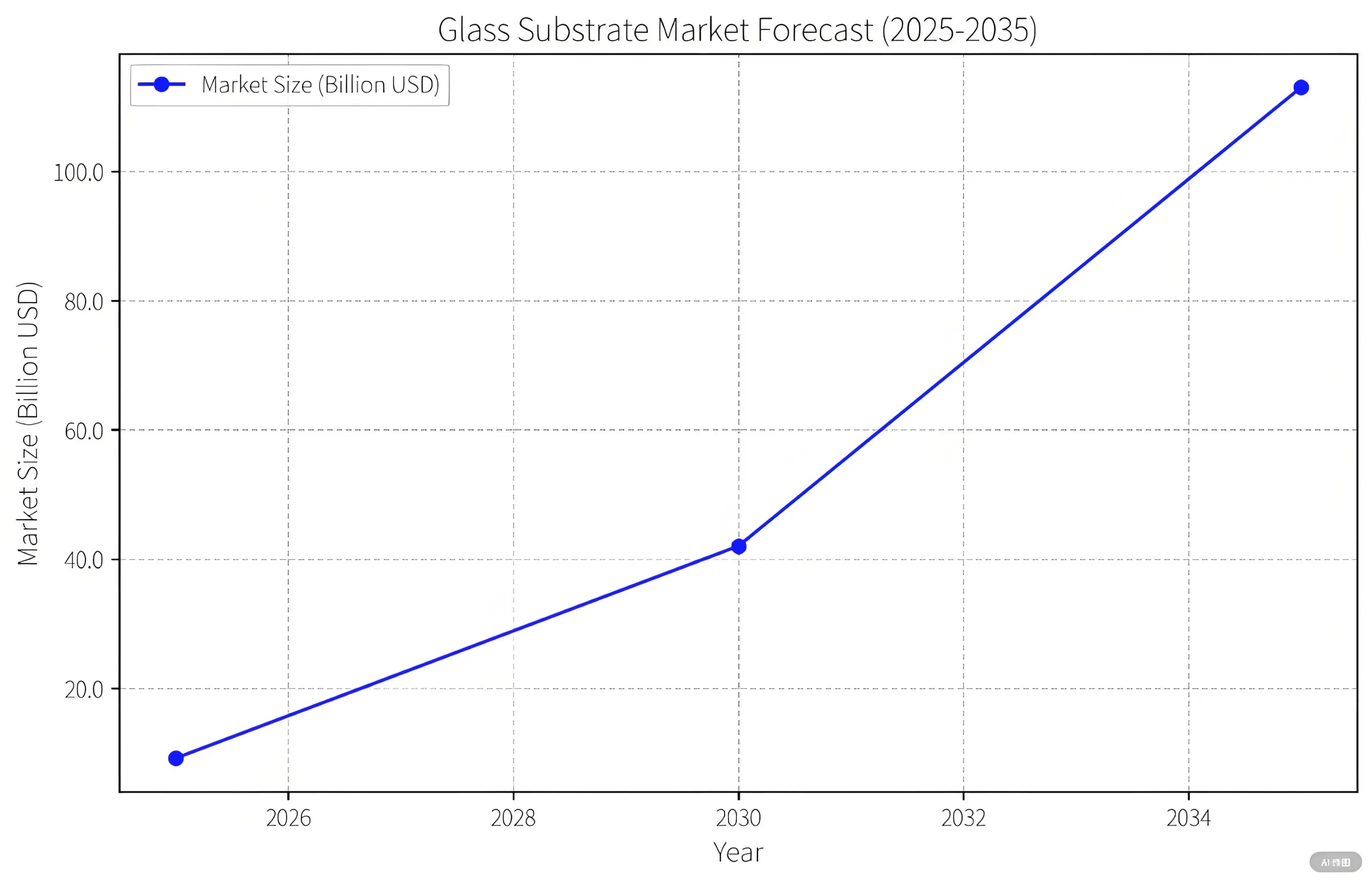

3.1 Market Growth Projections

Prismark forecasts explosive expansion:

-

2025: $916M (TGV substrates)

-

2030: $4.2B (full applications)

-

2035: $11.3B (entire ecosystem)

3.2 Geopolitical Tech Race

-

USA: Intel standards + Corning supply dominance

-

Korea: Samsung’s “Glass Alliance” + SKC’s 9-layer stacks

-

China: Wintech/AKM mass production + JFE 2026 localization

4. Challenges & Solutions: Commercialization Hurdles

4.1 Cost Reduction Pathways

Current 3-5× cost premium vs traditional substrates will plummet through:

-

85% large-panel (>2m²) utilization

-

90% laser drilling cost reduction

-

Metallization yield improvement (60%→92%)

4.2 Reliability Certification

New standards required:

-

Thermal Cycling (-55°C–250°C, 1,000 cycles)

-

EM Lifetime (MTTF >10⁷ hours @ JEP154)

-

High-Frequency Stability (<0.5dB/cm @100GHz)

5. PCB Industry Implications: Threat vs Opportunity

5.1 Market Disruption

-

30% HDI/substrate replacement risk

-

Hybrid (glass+resin) substrate opportunities

5.2 Technology Synergies

-

Picosecond laser drilling adoption

-

PVD-enhanced HDI trace precision

-

Optical inspection <0.1μm resolution

Conclusion: Transparent Substrates, Opaque Futures

China now leads critical TGV sectors (equipment, testing, materials). As Intel’s Pat Gelsinger notes: “Material innovation becomes the new Moore’s Law at atomic scales.” This glass-driven revolution may unlock semiconductor’s second growth curve.

UGPCB LOGO

UGPCB LOGO