Shortly after Nittobo announced a 20% price increase for its high-end glass fiber fabric, a procurement director at a major substrate manufacturer immediately called their Taiwanese supplier. The price of T-Glass had surged to $100 per kilogram, yet orders were already backlogged into the second quarter of the following year.

In this new era where the PCB industry is tightly linked to AI computing power, the cost and complexity of a single motherboard are rising at an unprecedented pace. PCB companies, traditionally reliant on consumer electronics, are transforming from simple “circuit carriers” into the “core enablers of computing performance.” A price adjustment notice issued by global electronic-grade glass fiber leader Nittobo on August 1, 2025, underscored the profound impact of AI servers on the PCBA supply chain—a blanket 20% increase for premium glass fiber materials.

01 Industry Shift: From Saturated Markets to the Heart of Computing

Not long ago, the PCB industry was caught in the fierce price competition of the smartphone market, with leading suppliers seeing gross margins consistently held below 20%. However, explosive demand from AI servers has rewritten the rules.

TrendForce research highlights a structural change: PCBs have officially entered a “triple-high” era—high frequency, high power, and high density.

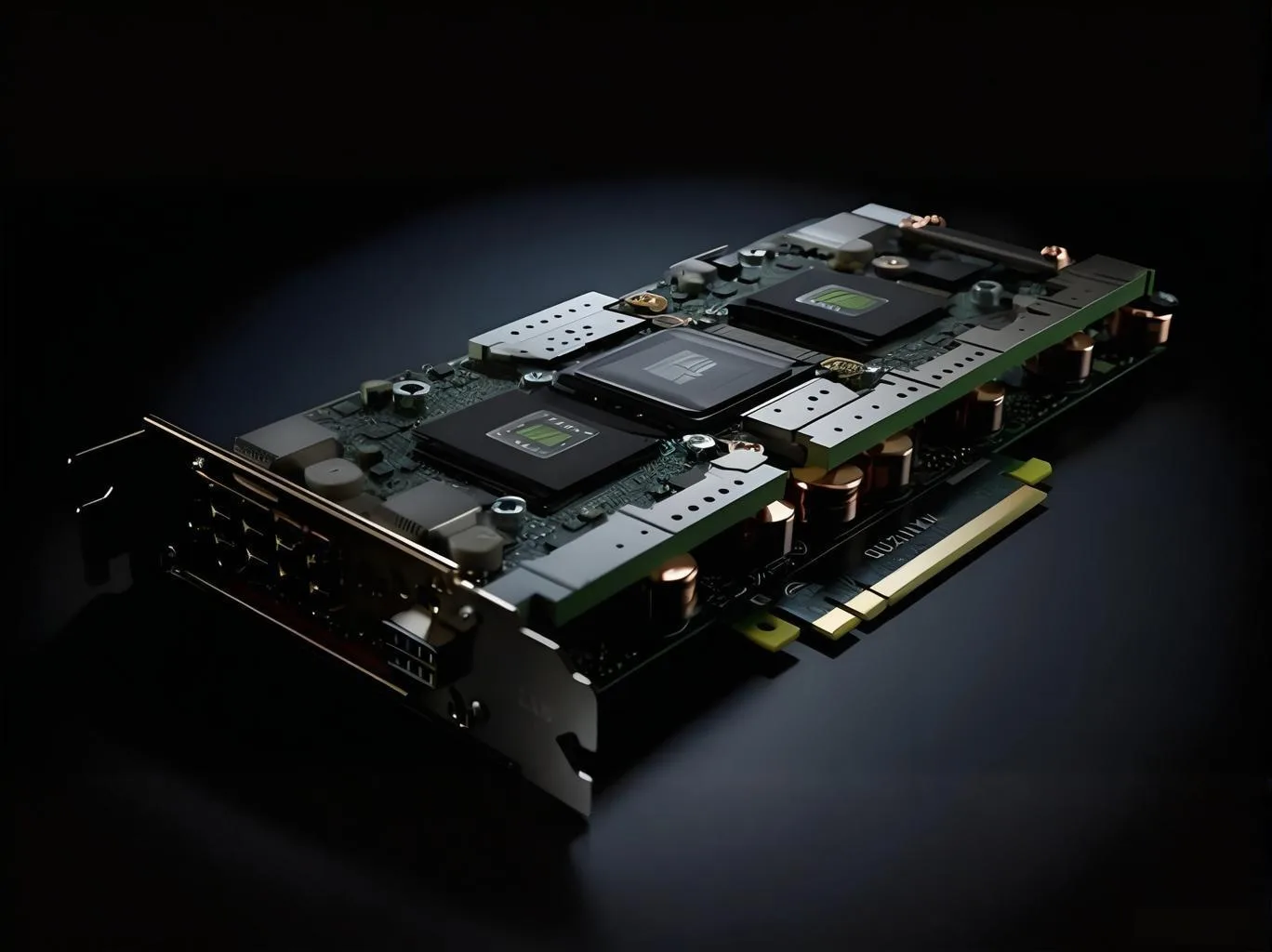

NVIDIA’s Rubin platform uses a cable-free interconnect design that has redefined traditional connectivity. Where high-speed transmission between GPUs and switches once relied on cables, multi-layer PCBs now handle these signals directly, imposing extreme requirements for signal integrity. This shift has more than doubled the PCB value per server compared to the previous generation.

02 Technology Catalyst: The Full-Scale PCB Materials Upgrade

The relentless performance demands of AI servers have triggered a qualitative shift in upstream materials. The design approach behind the Rubin platform has become an industry benchmark, with ASIC-based AI servers such as Google TPU V7 and AWS Trainium3 also adopting high-layer-count HDI, low-Dk materials, and ultra-low-profile copper foil.

In glass fiber fabric, Japan’s Nittobo is investing ¥150 billion to expand production of critical T-glass, with capacity expected to triple by the end of 2026 once mass production begins. With its low coefficient of thermal expansion and high modulus, T-glass serves as a core material for ABF and BT substrates, costing several times more than standard E-glass.

On the copper foil side, as high-speed transmission and skin effect challenges grow, ultra-low-profile HVLP4 foil has become standard. However, each successive grade upgrade reduces available capacity by roughly half, leading to persistent supply constraints. Designers of high-frequency, high-speed PCBs must now account for this materials bottleneck.

03 Strategic Importance: T-Glass Supply Shortage and Market Imbalance

T-Glass has become an indispensable strategic resource for AI chip packaging. This low-CTE glass fabric minimizes substrate warping during advanced packaging, significantly boosting AI chip yields and thermal efficiency.

Over 80% of the global T-Glass market is controlled by two players: Japan’s Nittobo and the U.S.-based PPG. Since the second half of 2023, Nittobo’s T-Glass lines have been operating at full capacity. Even as major PCB and IC substrate makers visit frequently, they often face extended waiting periods for delivery.

Severe supply-demand imbalance has pushed the price of top-tier T-Glass to a historic $80–$100 per kilogram. This price surge reflects not only short-term scarcity but also a new reality: those who control T-Glass hold significant influence over the AI supply chain.

In response, Taiwan Glass has begun retrofitting production lines. Its samples are currently undergoing a three-stage qualification process—from CCL manufacturers to substrate producers, and finally to end customers such as NVIDIA and AMD.

04 Supply Chain Realignment: Value Moves Upstream

AI-driven technological advances are redistributing value across the PCB supply chain. Where downstream assembly once captured the largest share, the balance is now shifting decisively.

In glass fiber fabrics, Taiwan Glass is expanding low-Dk material output; Jin Ju specializes in high-end HVLP copper foil; and Nan Ya maintains a strong position through its integrated “glass fabric + copper foil + resin” offering. This specialization has given upstream material suppliers unprecedented leverage in the AI era.

Extended lead times for copper-clad laminate (CCL) highlight the supply strain. Delivery times for CCL used in BT substrates have stretched from 8–10 weeks to 16–20 weeks, with suppliers recently hesitating to commit to firm dates due to tight supply.

New capacity is not expected to come online until mid-to-late 2026 at the earliest, offering little near-term relief. This structural shortage has made price increases a key tool for suppliers to restore margins, creating strong motivation to pass higher costs down the chain.

05 Competitive Landscape: The Rise of Taiwanese Suppliers

Taiwanese supply chain companies have demonstrated notable agility and technical expertise throughout the AI-driven PCB transformation, building advantages across several critical segments.

In the substrate sector, Unimicron, Nan Ya PCB, and Kinsus form a leading trio. Unimicron holds an estimated 30–40% share in the U.S. GPU market and is also a top global ASIC substrate supplier. Nan Ya PCB, with its dual focus on ABF and BT substrates and vertically integrated operations, has strengthened its negotiating position amid material shortages.

06 Looking Ahead: Innovation Beyond T-Glass

While T-Glass commands today’s attention, PCB technology continues to advance. The Rubin platform already incorporates more sophisticated material sets: the Switch Tray uses M8U-grade materials in a 24-layer HDI design, while the Midplane and CX9/CPX units integrate M9-grade materials with up to 104 layers.

Progress in low-Dk materials is also noteworthy. Materials like Q-glass and Low-Dk², used in certain CCL types, offer extremely low dielectric constants and loss tangents, pointing the way toward higher-frequency signal transmission.

From an AI server motherboard perspective, layer counts are climbing from 20 to 30–40 layers, with materials progressing toward M8 and M9 grades. Larger 800G switch and AI motherboard sizes are pushing processes such as via filling, thick-copper design, multilayer lamination, and laser drilling to new levels of complexity, with corresponding depth-related demands increasing by 12–14 times.

As Nittobo’s ¥150 billion capacity expansion begins to come online near the end of 2026, global T-Glass supply may gradually ease. Meanwhile, samples from emerging suppliers like Taiwan Glass are undergoing rigorous testing in NVIDIA’s labs. Successful qualification could redraw the map of the high-performance glass fabric market.

The industry’s old price-war battlegrounds are receding, replaced by a race toward technological sophistication. Companies that can secure a firm grip on advanced materials will define their position in this new AI-driven landscape.

UGPCB LOGO

UGPCB LOGO