1. Moteurs de l'évolution de la technologie des PCB et de l'innovation

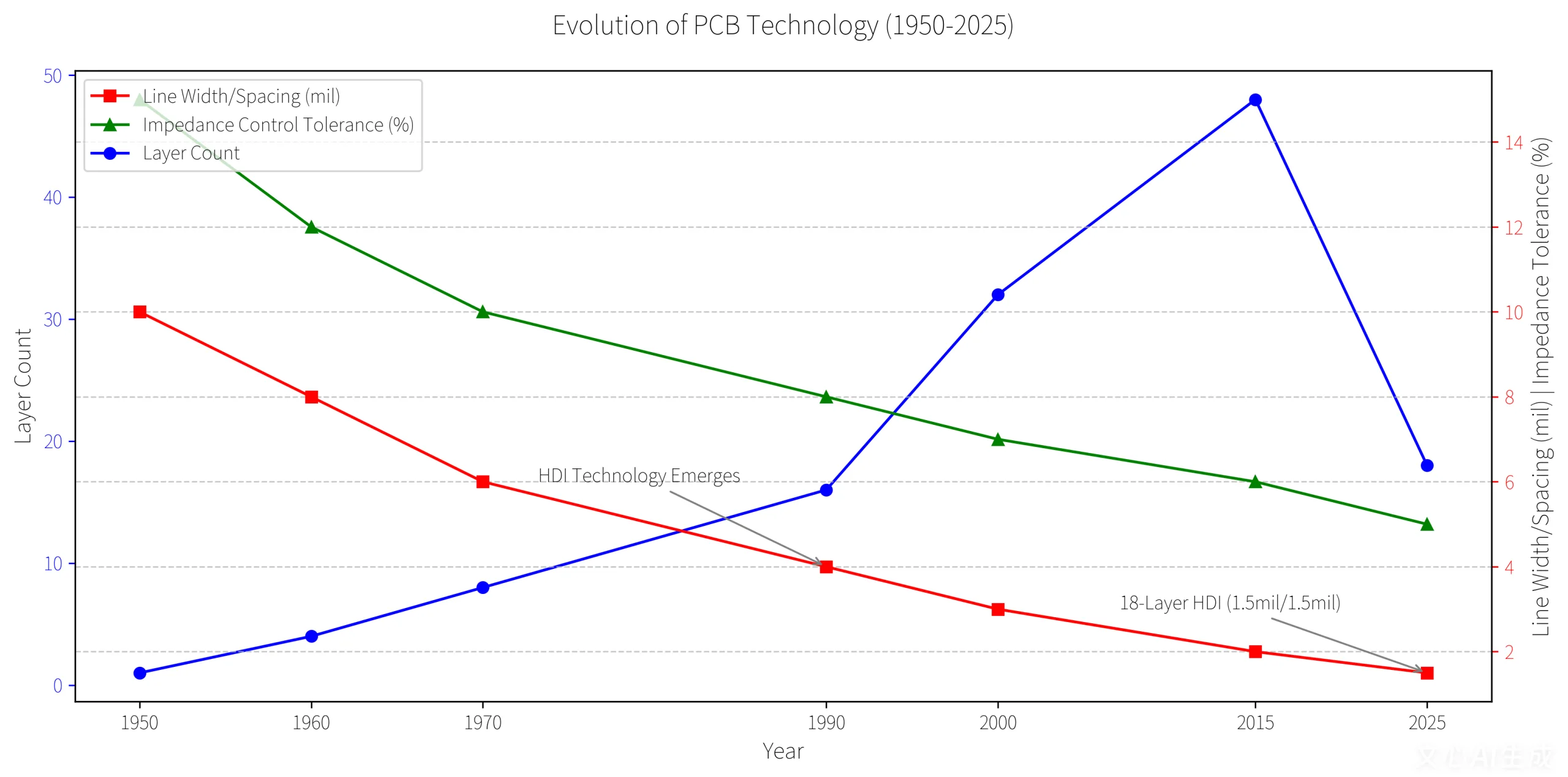

Le PCB (Circuit imprimé) sert de “Mère des produits électroniques,” Permettre une fixation mécanique et une connexion électrique des composants à travers des traces et des coussinets de cuivre. Les PCB modernes sont passés de cartes monocouches à une interconnexion à haute densité (IDH) et des tableaux multicouches, tiré par des demandes de performance élevées, miniaturisation, et fiabilité.

Méiteurs de marché clés:

- La demande de serveur AI a bondi 60% En yoy 2025, Boosting HDI et PCB multicouche adoption.

- Pénétration de l'électronique automobile, Surtout dans les véhicules électriques, Force la croissance des PCB à haute fiabilité.

- Le PCB de premier ordre à 10 couches d'UGPCB réduit la perte de signal par 42% Utilisation de traces de 2mil et de technologie microvia laser.

Percées techniques:

- Largeur de trace / espacement aussi bas que 1,5mil / 1,5mil (moyenne de l'industrie: 3mil).

- Tolérance au contrôle de l'impédance de ± 5% (Dépasse les normes de l'industrie par 10%).

2. Classification et applications PCB

2.1 Classification basée sur les couches

PCB unique: Designs simples (par ex., jouets, adaptateurs de puissance).

PCB à double couche: Utilise des vias pour l'interconnexion; Idéal pour les routeurs et les appareils électroménagers.

PCB multicouches (3+ Calques): Conceptions de haute densité pour les smartphones, systèmes automobiles, et contrôleurs industriels.

2.2 Matériel & Classification basée sur les processus

PCB rigides: Substrat FR-4 pour les dispositifs de forme fixe (téléphones, Téléviseurs).

PCB flexible (FPC): Basé sur des polyimides pour les applications pliables (câbles d'écran, appareils portables).

PCB-flex rigide: Combine des sections rigides et flexibles pour des assemblages complexes (drones, dispositifs médicaux).

3. Exigences spécifiques à l'application

3.1 Electronique grand public

- Smartphones: 12-calque des PCB rigides pour les processeurs, caméras, et modules RF.

- Ordinateurs portables: 6-10 Boches de couche pour les processeurs; FPCS pour les connexions de la batterie.

3.2 Électronique industrielle

- Contrôleurs AP: 4-6 calque PCB avec résistance EMC pour le contrôle du moteur.

- Capteurs: Cartes à double couches avec transmission de signal stable dans des environnements difficiles.

3.3 Électronique automobile

- Gestion de la batterie EV: PCB multi-couches pour surveillance de tension / température.

- Systèmes ADAS: Boards à rediabilité avec réponse au niveau de la milliseconde.

3.4 Applications haut de gamme

- 5G stations de base: 8-12 Boches RF de couche pour l'intégrité du signal haute fréquence.

- Dispositifs médicaux: PCB multicouches avec des matériaux biocompatibles pour les machines ECG.

4. Données du marché et projections de croissance

- Marché mondial des PCB: 155.38B par 2037.

- Cartes HDI: 33.4% part de marché par 2037, Poussé par les smartphones et les serveurs d'IA.

- PCB automobile: 18.79B par 2035 (TCAC 5.5%).

La domination de la Chine: Explique 50% de la production mondiale; PCB haut de gamme à atteindre 40% partager 2025.

5. Synergie PCB et SMT

Conception de PCB et CMS (Technologie de montage de surface) sont interdépendants:

- Les PCB fournissent des dispositions précises sur les tampons de soudure pour les composants SMT (par ex., 0402 résistances: 0.4mm × 0,2 mm).

- SMT permet un assemblage à haute densité, comme les puces BGA sur les PCB des smartphones.

L'avantage de l'UGPCB: Les systèmes d'imagerie laser LPKF atteignent une précision d'alignement de ± 25 μm, critique pour la production de HDI.

6. Défis et tendances futurs

Pressions sur les coûts:

- Les prix du cuivre ont augmenté 15% dans 2025;Stratifié plaqué cuivre (CCL) Les coûts ont augmenté 8-12%.

- PME Face à la compression de la marge, accélérer la consolidation de l'industrie.

Quarts de travail technologiques:

- Demande croissante de 8-16 calque PCB et substrats IC (taille du marché: $45B par 2025).

- À faible puissance, Matériaux de conductivité haute thermique pour les conceptions respectueuses de l'environnement.

Extension mondiale:

- Fabricants de PCB investissant en Asie du Sud-Est (Viêt Nam, Thaïlande) pour la rentabilité et l'évitement des tarifs.

Conclusion

L'industrie des PCB reste essentielle à l'électronique mondiale, conduit par l'IA, automobile, et 5G innovations. Les entreprises doivent prioriser les mises à niveau techniques, Diversification de la chaîne d'approvisionnement, et la fabrication verte pour s'épanouir au milieu de la volatilité des coûts et de la concurrence régionale.

LOGO UGPCB

LOGO UGPCB