Résumé exécutif

Les prix du cuivre ont dépassé le 10,000 Marque USD, les prix de l'or restent élevés, et les coûts des produits chimiques augmentent, créant une tempête de coûts parfaite balayant le PCB (Circuit imprimé) et PCB (Assemblage de la carte de circuit imprimé) chaîne d'approvisionnement. Cet article analyse les données derrière les flambées de prix, identifie les principaux facteurs déterminants, notamment la demande en plein essor des serveurs d'IA et des véhicules électriques, explore l'impact profond sur la structure et la rentabilité de l'industrie, et décrit des stratégies efficaces pour Fabricants de PCB pour traverser cette période difficile, de la substitution de matériaux à la collaboration dans la chaîne d'approvisionnement.

01 Volatilité des prix: Les données révèlent la flambée des coûts des matières premières

Cartes de circuits imprimés (PCB), souvent appelé le “mère des systèmes électroniques,” sont essentiels pour presque tous les appareils électroniques. Cependant, la structure des coûts de ce composant fondamental est actuellement soumise à une immense pression.

Les matières premières constituent environ 60% de la structure de coûts d'un PCB typique. La catégorie la plus importante est celle stratifié cuivré (CCL), comptabilité 27.31% du coût total. Les principaux matériaux pour les CCL : une feuille de cuivre, résine époxy, et les tissus en fibre de verre – connaissent tous des prix élevés et soutenus, monter directement Fabrication de PCB frais.

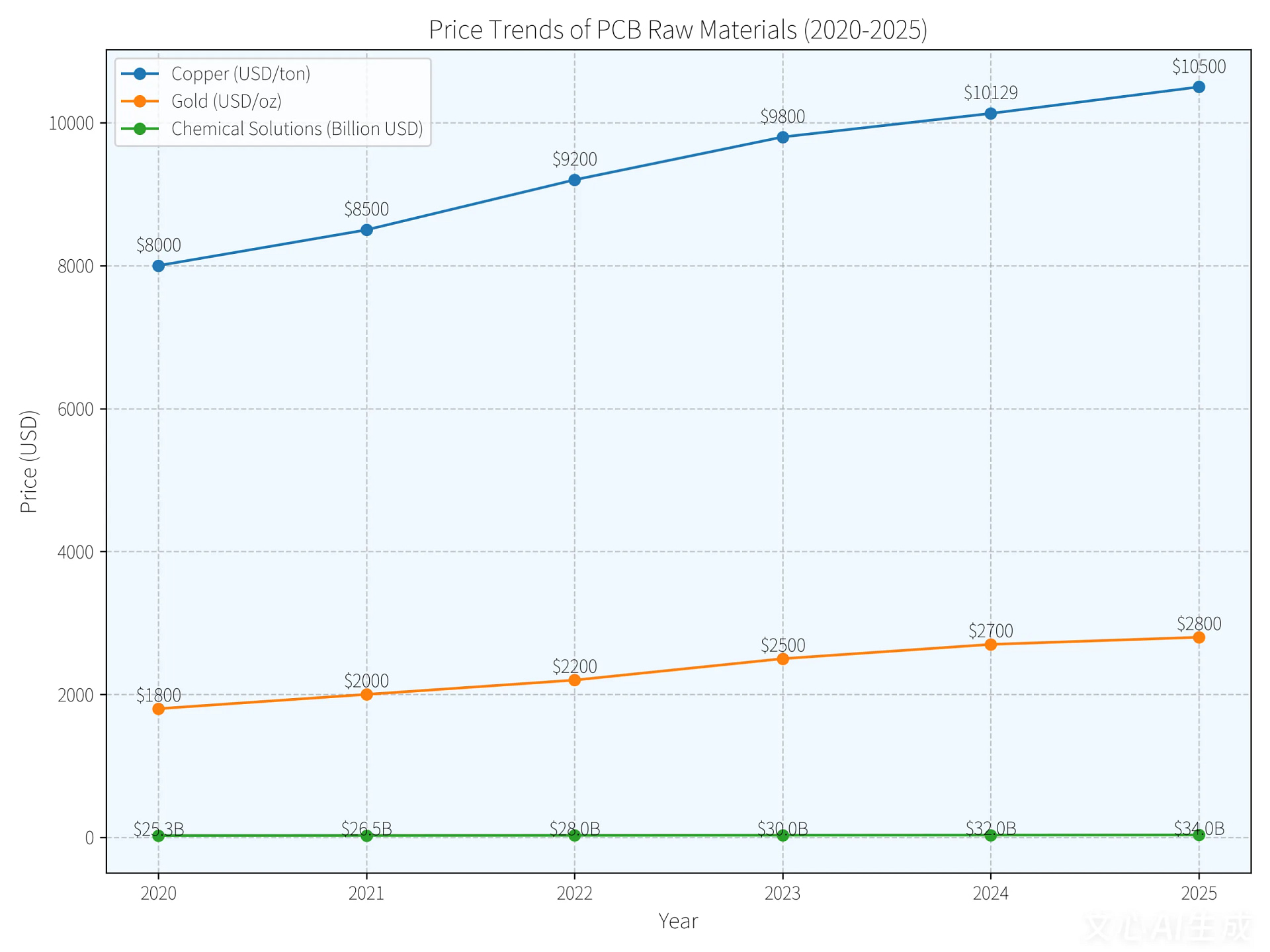

Cuivre, une référence clé, poursuit sa trajectoire ascendante. Les données de surveillance actuelles montrent le prix du cuivre électrolytique (1#) a atteint 85,430 RMB/tonne, un 5.2% augmentation de fin septembre à mi-octobre seulement. Plus inquiétant encore, les prix internationaux du cuivre ont déjà dépassé les 10,000 Jalon en USD, les contrats à terme sur le cuivre au LME dépassant brièvement $11,000 par tonne début octobre.

Au-delà du cuivre, d’autres matériaux essentiels connaissent également des augmentations de prix généralisées. Les prix des tissus électroniques en fibre de verre sont en hausse 12% année après année, certains fournisseurs annonçant un programme complet 20% hausse des prix de leurs produits en fibre de verre à partir d'août. Les produits chimiques contribuent également à la pression sur les coûts. Le prix de l’acide sulfurique (98%) augmenté de 1.6% mois après mois, tandis que la soude caustique (Alcali liquide, 32%) est passé par 1.1%. La hausse du coût de ces produits chimiques de base augmente directement le coût de production des solutions chimiques essentielles aux PCB.

02 Causes profondes: Les moteurs de la flambée des prix des matières premières

Cette vague d’inflation des matières premières n’est pas sans cause; c'est le résultat de plusieurs facteurs convergents.

Déséquilibre fondamental entre l’offre et la demande

Le marché mondial des PCB devrait atteindre $83.7 milliards dans 2025, un 4.2% croissance d'une année sur l'autre. Demande des secteurs à forte valeur ajoutée comme les serveurs, Équipement informatique IA, et les véhicules à énergies nouvelles continuent de grimper fortement, représentant maintenant plus de 35% du chiffre d'affaires total de l'industrie.

Boom de la demande en informatique IA

La croissance explosive de la demande en puissance de calcul pour l’IA a entraîné une expansion substantielle du marché des PCB haut de gamme.. Les données de l'industrie révèlent que les livraisons mondiales de serveurs d'IA ont augmenté de 68% année après année, provoquant une hausse de la demande plus élevée que prévu pour Cartes HDI et substrats d'emballage. Le nombre moyen de couches pour les PCB utilisés dans les serveurs IA haut de gamme est passé de 18 couches dans 2023 à 32 couches dans 2025, représentant un bond substantiel en termes d'exigences techniques et de valeur.

Expansion de l’électronique automobile

L’électrification des véhicules est un autre catalyseur majeur. Les ventes mondiales de véhicules à énergies nouvelles devraient atteindre 18.2 millions d'unités dans 2025, avec un taux de pénétration supérieur 24%. La valeur moyenne des PCB dans un véhicule électrique pur est 3.7 fois celui d'un véhicule à moteur à combustion interne traditionnel, stimuler considérablement la demande du marché des PCB.

Goulots d’étranglement de la chaîne d’approvisionnement

Les contraintes de capacité sont un problème crucial. L'industrie dépend fortement du haut de gamme importé Équipement de fabrication de PCB, avec des entreprises japonaises et allemandes qui conservent 80% de la part de marché mondiale. Les délais de livraison des équipements se sont allongés de 9 mois dans 2023 à 15-18 mois dans 2025. Cette incapacité à accroître rapidement la capacité pour répondre à la demande a entraîné un carnet de commandes dépassant $12 milliard.

03 Impact sur l'industrie: De la transmission des coûts à la restructuration du marché

L’effet d’entraînement de l’inflation des prix des matières premières se répercute sur l’ensemble de la chaîne industrielle des PCB..

Des marges bénéficiaires réduites

Avec des matières premières représentant une part si élevée de la nomenclature (Nomenclature), les fluctuations de prix impactent directement la rentabilité des entreprises. Alors que certaines grandes entreprises ont réussi à améliorer leurs marges brutes en optimisant leur mix produits et leurs portefeuilles clients, la plupart des petites et moyennes entreprises (PME) sont confrontés à des conditions de plus en plus difficiles.

Un paysage concurrentiel changeant

La dynamique concurrentielle du secteur subit un ajustement crucial. Les principaux fabricants consolident leurs avantages grâce à des mises à niveau technologiques et à l’expansion de leurs capacités., tandis que certaines PME, pressé par les coûts, sortent progressivement du marché du bas et du milieu de gamme. Les données montrent la part de marché combinée du leader mondial 10 Les fabricants de PCB ont atteint 52% dans 2025, une augmentation de 3 points de pourcentage par rapport 2024.

Évolution du mix produit et divergence des prix

La structure du produit évolue sensiblement. Les augmentations de prix sont les plus prononcées pour les produits PCB haut de gamme, en particulier ceux utilisés dans les serveurs IA, Interconnexion à haute densité (IDH) planches, et haute fréquence, PCB à grande vitesse. Dans 2025, prices for high-end PCBs rose 37.8% année après année, with delivery lead times stretching from the traditional 4-6 weeks to 12-16 semaines.

A significant price divergence between different application areas is emerging. The price per square meter for AI server PCBs has jumped from $800-$2,000 for traditional servers to $30,000-$50,000, an increase of 15-25 fois. This structural change is pushing the PCB industry towards a higher value-added transformation.

04 Survival Strategies: How PCB Companies Can Navigate the Crisis

Confronting the relentless surge in material costs, PCB manufacturers are deploying multi-pronged operational strategies to engineer market breakthrough solutions.

Material Substitution

In response to soaring copper prices, the electronics industry is actively preparing material substitution strategies. Des alternatives comme l'aluminium et l'acier sont en cours d'évaluation pour réduire les coûts de production. Les experts du secteur estiment que l'adoption de matériaux alternatifs peut effectivement réduire les coûts de production et freiner la demande de cuivre., contribuer à stabiliser les prix du marché mondial.

Mise à niveau technologique et optimisation du mix produit

C'est un choix courant pour les grandes entreprises. Capitaliser sur l’augmentation de la demande de PCB pour serveurs IA, les fabricants concernés améliorent le contenu technologique de leurs produits, réaliser un 2-3 point de pourcentage d'augmentation d'une année sur l'autre des marges brutes. Produits haut de gamme, tel que 20+ couche panneaux multicouches et cartes HDI de commande 6+, exigent des primes de prix importantes et sont devenus une source de profit cruciale.

Collaboration dans la chaîne d’approvisionnement et partage des coûts

Il devient de plus en plus important de bâtir des partenariats plus étroits avec les partenaires en amont et en aval pour gérer conjointement la volatilité des coûts.. Certains grands fabricants de PCB s’engagent même dans des participations au capital et dans des coentreprises pour sécuriser leur approvisionnement en matières premières en amont., améliorant ainsi la stabilité de la chaîne d'approvisionnement.

Efficacité des processus et recyclage

Pour les matériaux spécialisés comme les solutions chimiques, l’optimisation de l’efficacité d’utilisation et la mise en œuvre de programmes de recyclage sont des mesures efficaces de contrôle des coûts. En améliorant les processus comme le cuivrage des électrodes (PTH) et augmentation des taux d’utilisation de produits chimiques, les fabricants peuvent réduire efficacement le coût de fabrication par panneau PCB.

Mécanismes de tarification flexibles

Les entreprises révisent également activement leurs modèles de tarification, établir des stratégies d'ajustement des prix plus flexibles. Par exemple, certains relient directement les prix de vente des produits aux indices des matières premières, avec des ajustements réguliers pour refléter plus rapidement l’évolution des coûts.

05 Perspectives futures: Quand la flambée des prix s’atténuera-t-elle?

La question cruciale pour l'industrie demeure: quand cette tempête finira-t-elle?

Persistance à court terme

La dynamique des prix à court terme devrait rester intacte, le consensus de l'industrie prévoyant une pression à la hausse soutenue sur les produits PCB haut de gamme jusqu'au quatrième trimestre 2025, s'étendant potentiellement aux exercices ultérieurs. Avec l'adoption des matériaux M9 de nouvelle génération à partir de 2026 et mise à l'échelle 2027, les prix des PCB haut de gamme devraient encore augmenter 30%-50%.

Soulagement à long terme grâce à la technologie

À long terme, l’itération technologique sera essentielle pour atténuer la pression sur les coûts. L'industrie des PCB connaît une révolution des matériaux. Le saut de performance des matériaux M8 vers M9 apportera des capacités produit améliorées, compensant partiellement l’impact de la hausse des coûts des matières premières. Simultanément, la montée en puissance des fournisseurs nationaux de matières premières contribuera à améliorer la stabilité de la chaîne d'approvisionnement.

Facteurs de demande soutenus

Du point de vue de la demande, IA, véhicules électriques, et la communication 5G/6G restera les trois principaux moteurs de la croissance de l'industrie des PCB. Avec l’augmentation des expéditions mondiales de serveurs IA 68% d'une année sur l'autre et la pénétration des PCB dans les véhicules à énergie nouvelle dépasse 75%, ces secteurs à forte croissance continueront de stimuler la demande de PCB avancés.

Consolidation de l'industrie

L’ajustement structurel et la concentration accrue du marché définiront les années à venir. Fabricants chinois, tirer parti des effets de grappe industrielle et des capacités de contrôle des coûts, ont vu leur part de marché casser 40% pour la première fois, devenir le principal moteur de croissance de l’industrie mondiale des PCB. Pour les entreprises incapables de s’adapter à cette transformation, sortir du marché ou être consolidé peut être une issue inévitable.

Les prix du cuivre continuent de fluctuer à des niveaux élevés, et r&La transition vers les alternatives à l’aluminium s’accélère. En parcourant un Usine de PCB, le bourdonnement des machines demeure, mais la structure des coûts de chaque circuit imprimé a irrévocablement changé.

“Cette flambée des prix est un bouleversement pour l’industrie,” a remarqué un directeur d'usine avec vingt ans d'expérience. “Les entreprises qui rivalisaient uniquement sur des prix bas seront éliminées. Ceux qui restent doivent maîtriser les technologies de base.”

Le marché mondial des PCB devrait atteindre $96.8 milliards dans 2025. Les survivants de cette tempête de coûts sont sur le point de revendiquer une plus grande part de ce gâteau en pleine croissance..

LOGO UGPCB

LOGO UGPCB