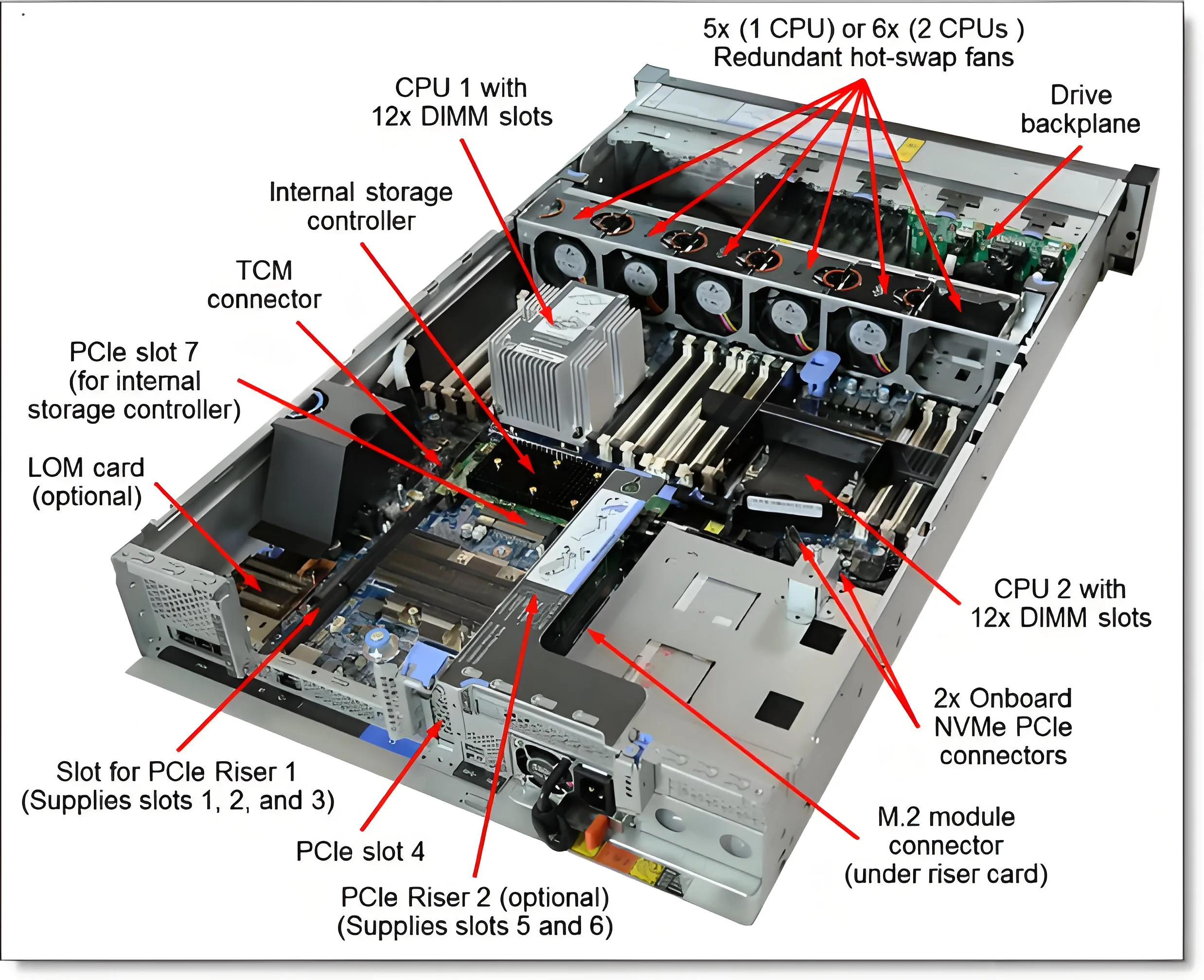

A 0.3mm nano-ceramic substrate is quietly tipping the technological balance of the billion-dollar AI computing market. Inside NVIDIA’s latest DGX AI servers, cel PCB value per unit has surged to ¥12,000 – five times higher than traditional servers. These “computing engines” rely on meticulously arranged circuit networks resembling electronic neural systems, handling high-speed data flows up to 112 GBPS.

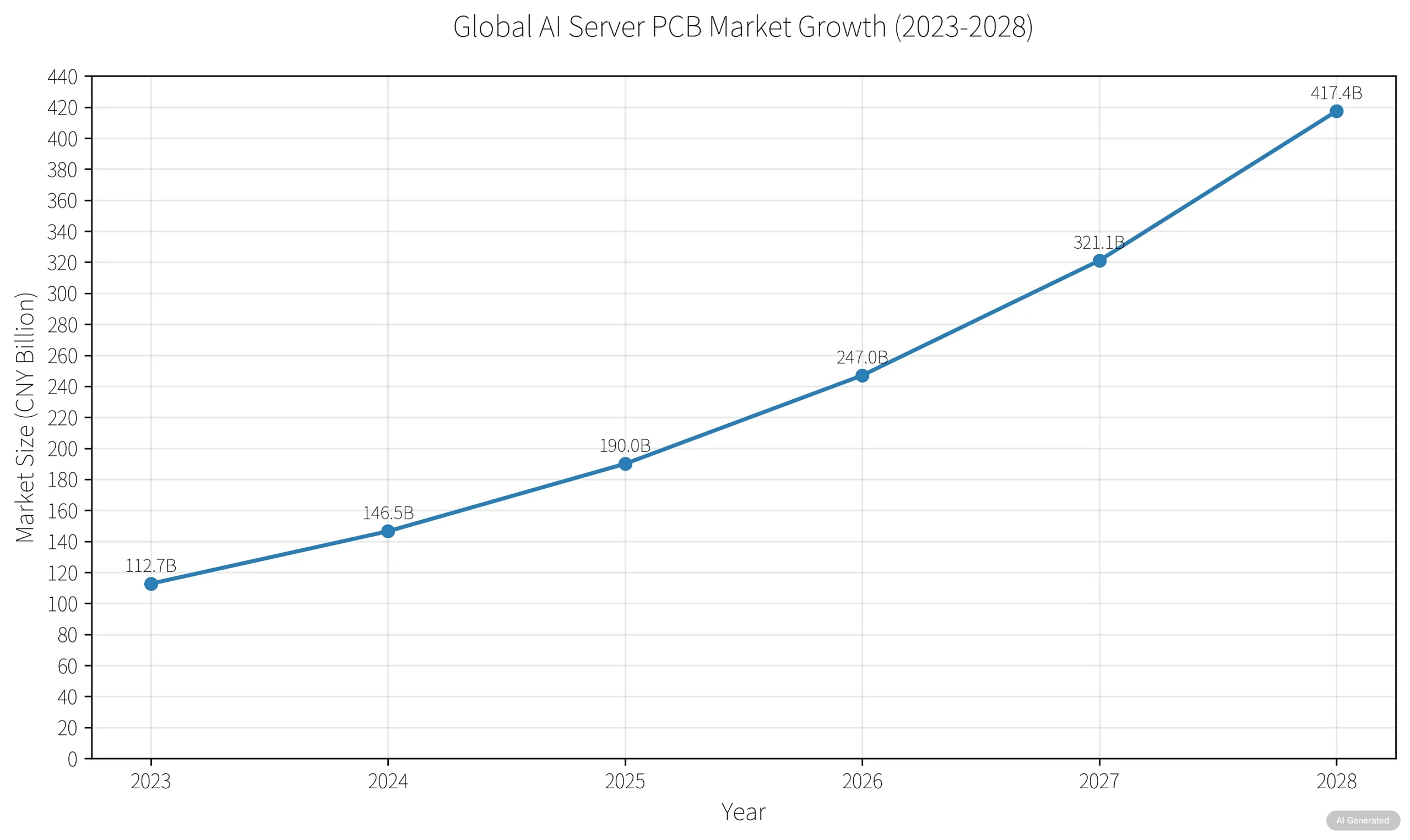

In H1 2025, Shengyi Electronics projects 432%-471% YoY net profit growth, with industry leaders like Avary Holding and Shengyi Technology exceeding 50% creştere. Behind this surge lies a fierce battle for domestic substitution of advanced Materiale PCB:

-

Global supply gap for high-end electronic materials: 25%-30%

-

Price surge since 2024: 250%-300% for specific models

-

AI server hydrocarbon resin prices: ¥1,000,000/ton (60× epoxy resin)

Material Revolution: Breaking Through Technical Bottlenecks

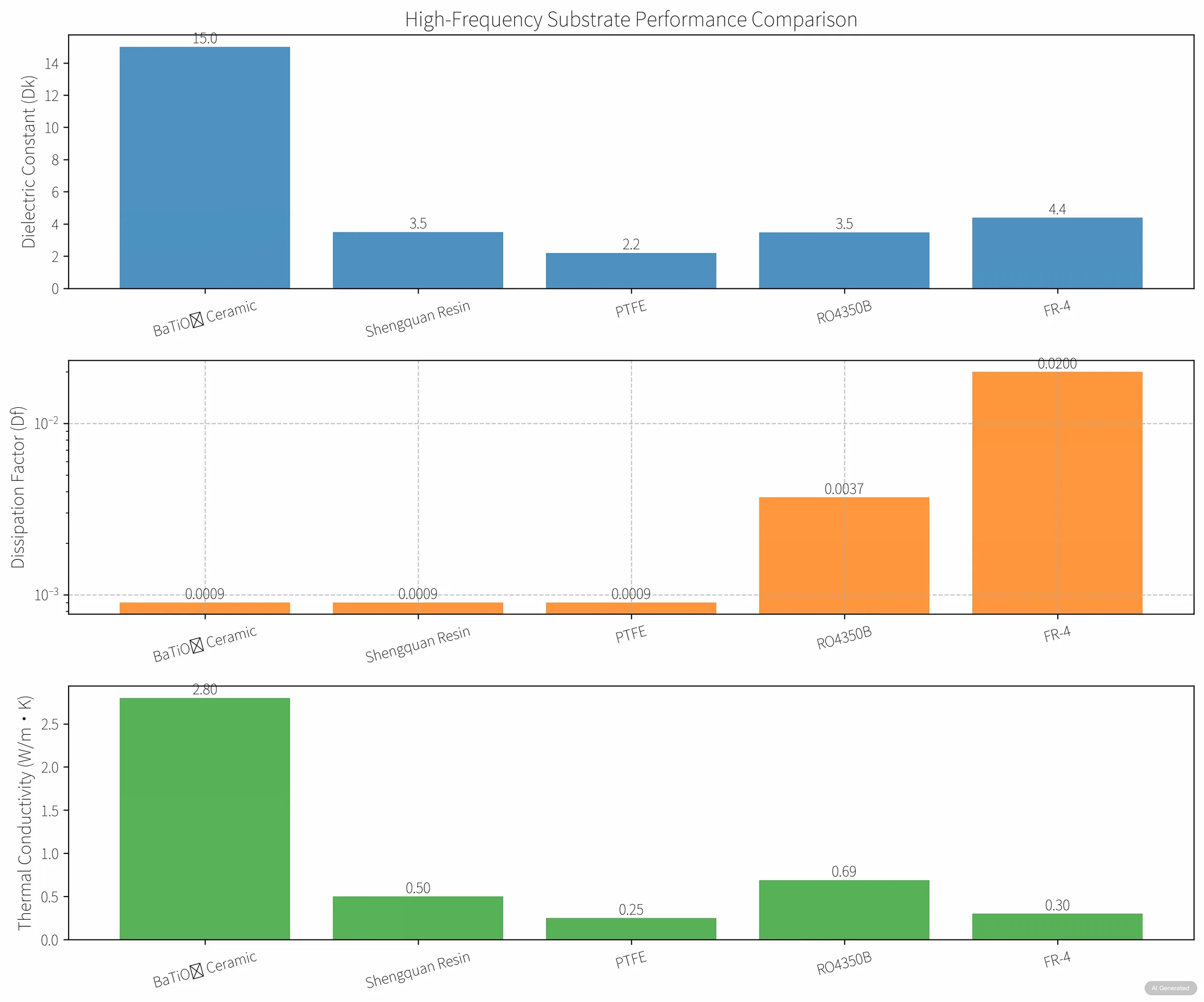

High-frequency material breakthroughs form the core battlefield for China’s PCB industry. Driven by 5G mmWave communication and AI chips, traditional FR-4 substrates (Df>0.02 provocând >0.8dB/inch signal loss) fail to meet high-end demands.

Nano-scale Material Innovations

-

BaTiO₃ nano-ceramic substrates achieve Dk=15±0.5, Df<0.001 la 10 GHz with 2.8W/m·K thermal conductivity (9× improvement)

-

Shengquan Group captures 20% market share with ultra-low-loss resins (Df<0.001), entering NVIDIA’s GPU supply chain

-

Shiming Technology’s aggressive expansion to 2,500-ton capacity by 2026 will cover 31% of global demand growth

Domestic Resin “Big Three” Emerge

-

Dongcai Technology: 3,500-ton capacity certified by TUC

-

Shengquan Group: Q1 2025 net profit ↑50.46%

-

Shiming Technology: $760M valuation with $140M projected post-expansion revenue

Manufacturing Evolution: From HDI to Nano-ceramic Paradigm Shift

As 5G base stations advance to mmWave and AI server PCBs reach 20-30 straturi, the industry transitions from density competition to performance revolution.

Hybrid Material Breakthroughs

-

Localized high-frequency material technology embeds Rogers RO4350B (Df=0.0037) in signal layers, reducing 28GHz insertion loss by 18% while cutting costs 22%

-

Z-axis CTE differential compressed to <5PPM/° C. through resin bridging, trecere 50,000 Cicluri termice

Nano-scale Precision Manufacturing

-

LDI adoption to rise from 45% (2025) la 75% (2030), enabling 0.1mm line width

-

World’s first 70-layer PCB + 6-step 24-layer HDI achieved

-

Circuite Shennan’ IC substrates reach 15μm line width (1/6 păr uman)

Market Restructuring: Golden Window for Domestic Substitution

2025 global PCB market: $96.8B (China: $60B >50% share), yet <35% self-sufficiency in high-end segments creates unprecedented opportunities.

Computing Revolution Drives Demand

-

AI server PCB value: $700/unit (3× traditional)

-

2024 global AI server shipments: 421,000 units → 28% HF PCB growth

-

NVIDIA Rubin backplane: $200,000/unit → $2.3B profit potential

Automotive Electronics Expansion

-

EV electronics penetration: >65% → Automotive PCB share ↑12% (2020) la 20% (2025)

-

L4 autonomous vehicle PCB value: >$280

-

BMS PCBs withstand -40℃~150℃

-

LiDAR rigid-flex PCBs: 0.2mm thickness, <1mm bend radius

Policy Support: Building Autonomous Supply Chains

China’s 14th Five-Year Plan prioritizes high-performance PCBs şi advanced CCL materials. Regional initiatives include:

-

Guangdong’s “glass fiber → CCL → PCB → packaging → smart devices” cluster

-

Chongqing’s $2.8B PCB industrial base

-

Guangde Economic Zone’s integrated supply chain

EU CBAM regulations drive eco-upgrades: Avary’s lead-free process coverage >80%, single-layer energy consumption ↓25%.

Future Battlefield: From Manufacturing Hub to Value Ecosystem

With CR10 at 58%, China’s PCB industry transitions from scale competition to ecosystem warfare.

Technological Convergence

-

Shengyi Tech’s M4/M6 HF CCL: Rogers-grade at 30% lower cost

-

Programmable substrates with Dk=6-12 dynamic adjustment for 6G

Global Expansion Strategies

-

Dongshan Precision: 15% tariff reduction via Vietnam base

-

Avary acquires M-Flex for automotive FPC tech

-

Shennan Circuits buys ASMPT for IC substrate capabilities

Smart Factory Paradigms

-

“Dark factories” achieve 100% equipment connectivity

-

AI inspection: >99% defect recognition

-

Lamination yield ↑92% to 99.1%

Strategic Roadmap: Dominating Billion-dollar Opportunities

Facing 25% CAGR in AI servers (2.37M units by 2026), focus on three fronts:

Material Independence

BaTiO₃ nano-ceramic substrates at 25% cost reduction

Electronică auto

High-temp BMS FPCs with 15% resistance reduction

Smart Manufacturing

AI-driven systems cutting prototyping from 7 zile pentru a 48 ore

China’s PCB industry stands at an inflection point. Companies mastering HF substrate core technologies and building vertical ecosystems will define next-gen electronic interconnect standards.

Seize dual opportunities in AI computing and automotive electronics. Contact us for custom high-frequency PCB solutions – Your technical challenges drive our breakthroughs.

LOGO UGPCB

LOGO UGPCB